1. About this Document

This target market determination (TMD) is required under section 994B of the Corporations Act 2001(Cth) (the Act). The purpose of this TMD is to provide information regarding the key attributes of the class of consumers for which this product has been designed, having regard to the objectives, financial situation and needs of the target market. In addition, the TMD outlines the triggers for review of the target market and certain other information, and forms part of CryptoSpend Pty Ltd’s (trading as Wayex) design and distribution arrangements for the product.

Wayex provides the facility for making non-cash payments through the Wayex Card and a corresponding Wayex account. Flexewallet Pty Ltd (Flexewallet) is the distributor and issuer of the Wayex Card.

This TMD is not to be treated as a full summary of the product’s terms and conditions and is not intended to provide financial advice. Consumers must refer to the Product Disclosure Statement (PDS)and the Terms and Conditions for the product before making any decision regarding this product.

Date from which this target market determination is effective

19/05/2023

2. Class of consumers that fall within this target market

The information below summarises the overall class of consumers that fall within the target market for the Wayex Card, based on the product’s key attributes and the objectives, financial situation and needs of consumers that it has been designed to meet. The target market for the product includes the following class of consumers:

Consumers who satisfy each of the following criteria:

- consumers over the age of 18;

- consumers with a Wayex account;

- consumers not operating under a business entity;

- consumers utilising their own funds under the Wayex account for point of sale purchases, at an ATM, or online;

- consumers who acknowledge that cryptographic tokens or digital assets available to be transacted through the non-cash payment facility provided by Wayex are highly volatile and require a sophisticated knowledge of information technologies and blockchain technologies as well as security systems to properly secure;

Those consumers who satisfy the above criteria and wish to use the Wayex Card to use cryptocurrency or AUD on everyday purchases using the Wayex Card, presenting it at point of sale, at an ATM, or online wherever Visa is accepted, are in the target market for the Wayex Card.

Product description and key attributes

The key eligibility requirements consumers must meet to be able to use the product, and the attributes of the product are as follows:

- The Wayex Card is a reloadable prepaid Visa card with the following attributes:

- the ability to purchase eligible goods and services where Visa cards are accepted;

- the ability to link the Wayex Card to a consumer’s nominated digital wallet, allowing consumers to make purchases with eligible mobile devices;

- the requirement to nominate a cryptocurrency to redeem and use for purchases with the Wayex Card and to pay fees for using the Wayex Card;

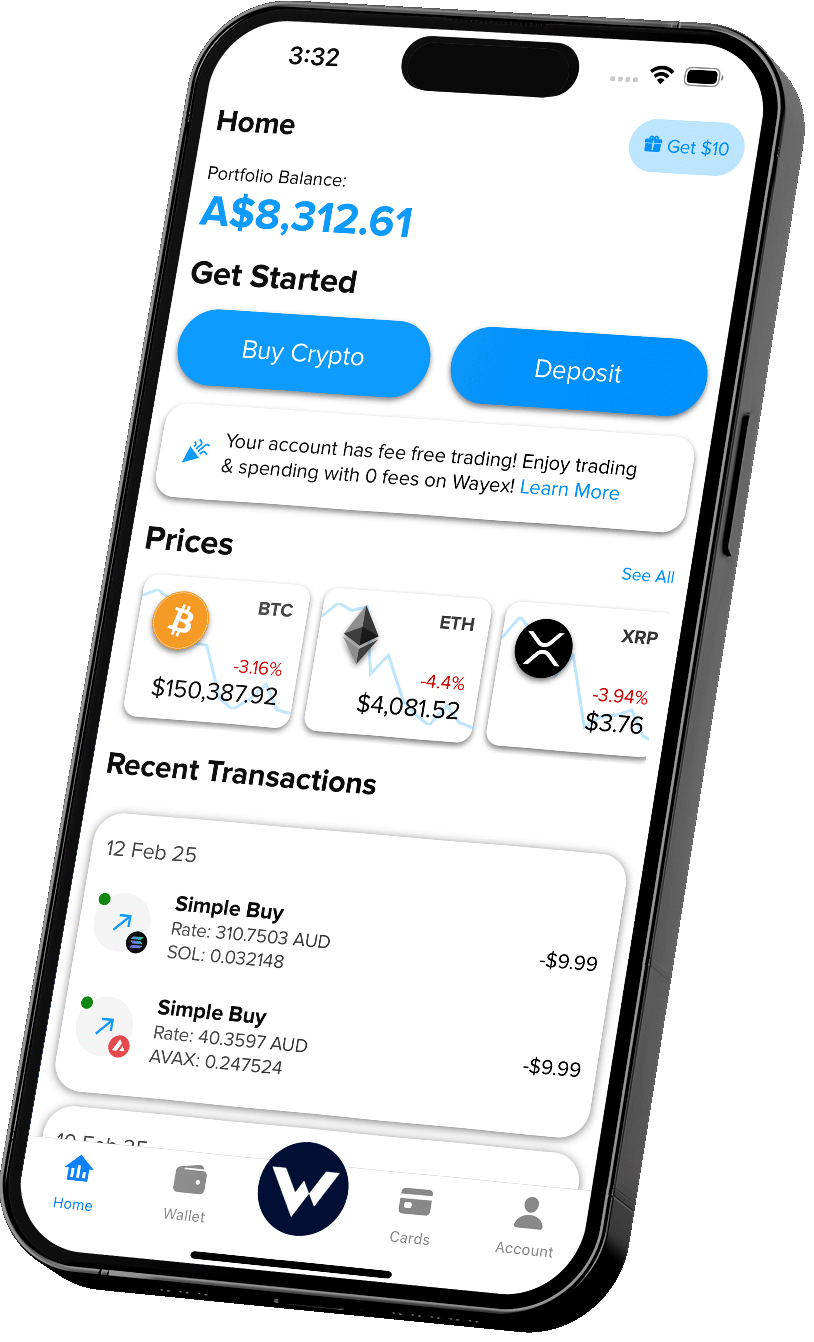

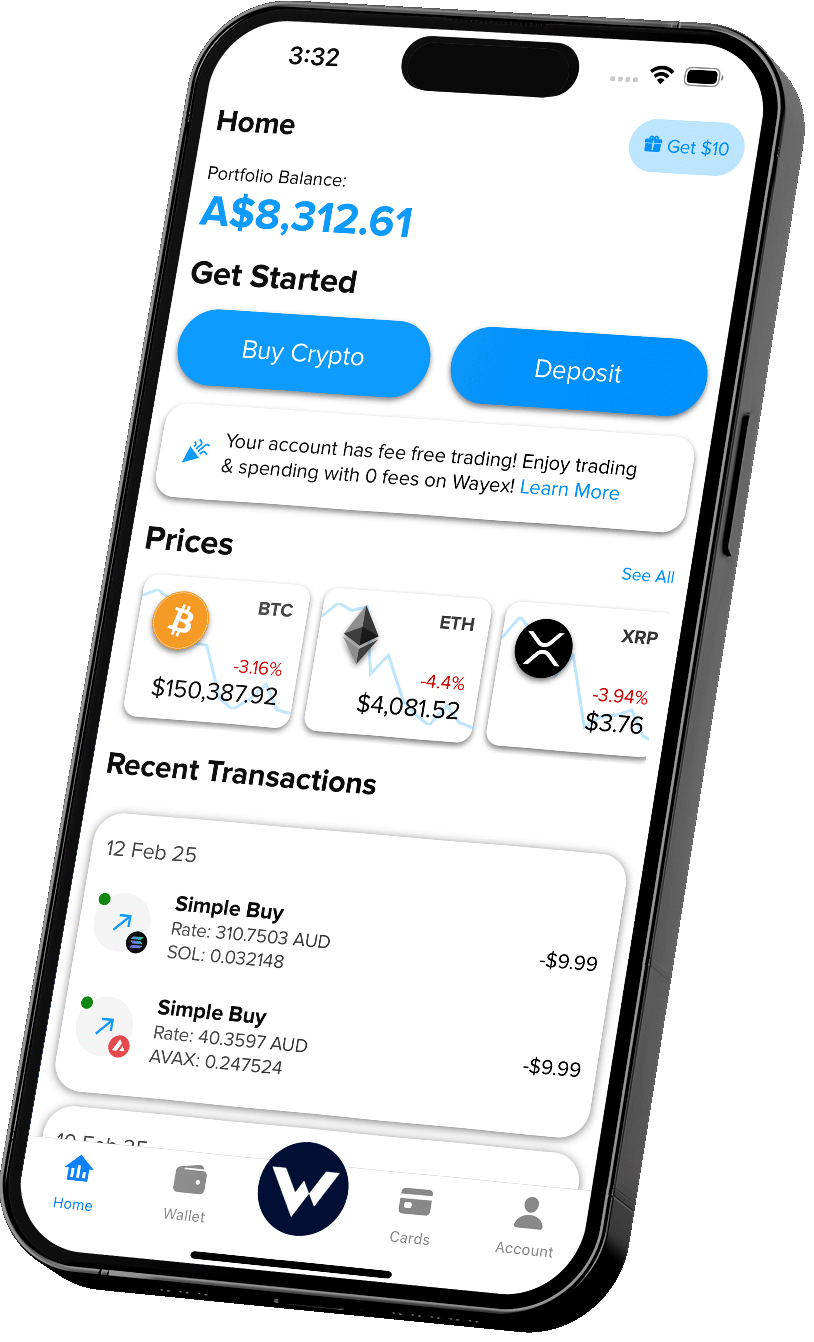

The Wayex App provides an interface for Consumers using the Wayex Card and enables Consumers to send funds digitally to their nominated bank accounts or through BPay. Additionally the Wayex App provides Consumers the ability to purchase cryptocurrencies using the Wayex App which are deposited in the consumer’s nominated digital wallet .

- The eligibility requirements of the class of consumer who makes up the target market:

- all users must be over the age of 18 to create an account with Wayex ;

- all users must have a permanent residential address in Australia or be an Australian citizen or permanent resident, and hold a valid Government issued identification (passport or driving licence);

- all users must have an account with the distributor of the Wayex Card; and

- all users must agree to the Terms and Conditions and the PDS.

Objectives, financial situation, and needs

This product has been designed for individuals who:

- have cryptocurrency within their Wayex account available to make purchases with the Wayex Card and to pay any fees associated with the use of the Wayex Card; and

- wish to be provided a way to use their cryptocurrency balances to facilitate point of sale purchases, at an ATM, or online.

Excluded class of consumers

This product has not been designed for individuals who:

- are under the age of 18;

- do not have a Wayex account;

- do not hold a valid government issued identification, do not have an Australian residential address, or are not an Australian citizen or permanent resident;

- do not have a permanent residential address in Australia;

- are not an Australian citizen or permanent resident;

- consumers who do not understand that cryptographic tokens or digital assets available to be transacted through the non-cash payment facility provided by Wayex are highly volatile and require a sophisticated knowledge of information technologies and blockchain technologies as well as security systems to properly secure; or

- do not hold a valid Government issued identification (passport or driving licence).

Consistency between target market and the product

The product (including its key attributes) is consistent with the objectives, financial situation and needs of Consumers in the target market as:

- the product provides a way through the Wayex Card for Consumers with a Wayex account to use/spend cryptocurrency in their account through the Wayex Card;

- the product allows Consumers to make payments through the Wayex Card, or cause payments to be made with cryptocurrency through the Wayex Card, rather than through the physical delivery of cash for everyday purchases; and

- the product provides the means to redeem cryptocurrency within the Consumer’s Wayex Account into AUD for the exact amount of the relevant transaction with the Wayex Card, without the need to first redeem a predetermined amount of cryptocurrency into AUD prior to the transaction.

3. How this product is to be distributed

Wayex provides access to the Wayex accounts, and facilitates the services to make cryptocurrency payments through the Wayex Card. It should be noted that the Wayex Card is issued and distributed by Flexewallet. Consumers are advised that Wayex is not the issuer of the Wayex Card.

Distribution channels

This product is designed to be distributed to consumers through the following means:

- advertising through media (including social media), physical marketing materials (such as banners, brochures or flyers) and any other marketing material available to the general public;

- the Wayex website;

- the Wayex App; and

- any other Wayex approved communication channels (including email).

- Physical cards are distributed and delivered by Australia Post

This condition is appropriate as the target market for obtaining an account with Wayex, through which the product is available, is wide.

Distribution conditions

To ensure that the distribution strategy is consistent with the identified target market of the product, there are processes in place to ensure that the Consumers who are potential users fall within the identified target market. Those processes are specified as follows:

- the product will only be made available to Consumers who have a verified account with Wayex and therefore agree to Wayex’s PDS and Terms and Conditions;

- the product will only be made available to Consumers who have passed AML/KYC checks in accordance with the Terms and Conditions; and

- the product will only be distributed to Consumers through Wayex's digital platform (such as their website or mobile app) and other Wayex approved communication channels.

Flexewallet will also take reasonable steps to ensure that the marketing strategy in targeting potential Consumers who fall within the identified target market of the product.

Adequacy of distribution conditions and restrictions

The distributions conditions are appropriate as the target market is limited to those who have an account with Wayex, and it is the most appropriate method for Consumers within the target market to obtain and use the product.

4. Reviewing this target market determination

Flexewallet will review this target market determination in accordance with the below:

Within 12 months of the effective date.

Initial Review

Mandatory periodic reviews

On each anniversary of the first review date.

Review triggers

or events

The following events or circumstances would reasonably suggest that the TMD is no longer appropriate and will trigger a review:

- where there is a material change to the design or distribution of the product, including the product’s related documentation such as Wayex’s PDS and Terms and Conditions;

- the occurrence of a significant dealing (as that term in defined in the Act) outside of the target market of the product as identified in this TMD;

- where the distribution conditions are found to be inadequate through monitoring of our day-to-day activities, or the monitoring and supervision of our Distributors;

- there is a material change in the Distribution Conditions associated with the Wayex Card;

- where we have received six or more complaints within a two month period or noted any relevant complaints trends;

- external events such as adverse media coverage;

- where there are material changes to laws and regulatory guidance that affects the product; or

- any other event or circumstance that would materially change a factor taken into account in making this target market determination.

Where a review trigger has occurred, this target market determination will be reviewed within 10 business days.

4. Reviewing this target market determination

We may collect the following information from our distributors in relation to this TMD.

Distributors of the product will report all complaints in relation to the product

covered by this TMD on a monthly basis. This will include written details of the

complaints.

Complaints

Significant

dealings

Distributors of the product will report if they become aware of a significant

dealing in relation to this TMD within 10 business days.

Product data

Distributors of the product will report monthly on the state of quantitative data regarding the product, including the number of consumers and the volume of transactions.

Consumer

feedback

Distributors of the product will report on the state of qualitative consumer feedback in relation to the product covered by this TMD on a monthly basis. This will include written details of the feedback received.